virginia electric vehicle tax credit 2022

Hybrid car tax credits work by giving you a nonrefundable credit on your income tax return. Download and complete the License Plate Application VSA 10 including the vehicle identification number VIN and title number.

Why Electric Cars Are Only As Clean As Their Power Supply Electric Hybrid And Low Emission Cars The Guardian

The federal tax credit falls to 22 at the end of 2022.

. A qualified resident of the Commonwealth who purchases such vehicle shall also be eligible for an additional 2000 enhanced rebate. X5 xDrive45e PHEV Chrysler. The EV tax credits that are being proposed for 2022 are larger and more robust than previous and current electric vehicle tax credits.

Electric Vehicle EV Charging Bill Credit Rappahannock Electric Cooperative REC added 542022. And potentially even more importantly these tax credits will be refundable. The state of Virginia is not the only sector willing to reward customers for the purchase of an EV as well as a Plug-In Hybrid PEV.

State andor municipal tax breaks may also be available. The federal government also offers drivers a variety of rebate programs that can be used to offset part of the costs to purchase residential EV chargersAs of February 2022 residents in any state can get an income tax credit to help defray the cost of both EV chargers and EV charger installations. Reference House Bill 450 2022 Electric Vehicle EV Rebate Program Working Group.

Carry forward any unused credits for 3 years. Claim the credit against the following taxes administered by Virginia Tax. The credit amount will vary based on the capacity of the battery used to power the vehicle.

Electric Vehicle EV Parking Space Regulation added 5132022. The Build Back Better bill will increase the current electric car tax credit from 7500 to 12500 for qualifying vehicles. The credit amount will vary based on the capacity of the battery used to power the vehicle.

How much you save with the West Virginia electric vehicle incentive West Virginia doesnt offer electric vehicle incentives on the state level but owners of all-electric vehicles and plug-in hybrid electric PHEV vehicles may be eligible for up to 7500 in federal tax credits. Hybrids and electric vehicles may not be a tax write off but may instead be eligible for a credit on your return. The legislation will be introduced when the Virginia General Assembly convenes on January 13 2021.

Federal solar investment tax credit. Reference Virginia Code581-2217 and 581-2249 Electric Vehicle EV. An income tax credit equal to 1ȼ per gallon of fuel produced.

The maximum credit allowed is 5000 not to exceed your tax liability. Beginning January 1 2022 a resident of the Commonwealth who purchases a new electric motor vehicle from a participating dealer shall be eligible for a rebate of 2500. The amount of the credit will vary depending on the capacity of the battery used to power the car.

Virginia Department of Taxation website. The credit is also transferrable. Bentayga Hybrid PHEV BMW.

An annual highway use fee will be assessed on each electric motor vehicle registered for highway use in Virginia. Cap is 6 million per year. Biodiesel Production Tax Credit.

The credit is also transferrable. DMV Registration Work Center. The credit is also transferrable.

Check that your vehicle made the list of qualifying clean fuel vehicles. Small neighborhood electric vehicles do not qualify for this credit but. Electric Vehicle EV Infrastructure Support.

In addition to credits Virginia offers a number of deductions and subtractions from income that may help reduce your tax liability. An additional 2000 rebate would be. Reference Virginia Code 581-4391202 Agriculture and Forestry Biofuel Production Grants.

Reference Virginia Code 581-4391202 Agriculture and Forestry Biofuel Production Grants. Either fax your application to 804 367-6379 or mail it to. January 13 2022 If youve been shopping for or researching an electric vehicle youve almost certainly heard about things like EV tax credits specifically the federal governments offer of a.

Electric Vehicle EV Rebate Authorization added 5132022. January 13 2022 - To get the federal EV tax credit you have to buy a new and eligible electric car. 1 2022 would offer buyers a 2500 rebate for the purchase of a new or used electric vehicle.

To learn more about the Land Preservation Tax Credit see our Land Preservation Tax Credit page. 1 2022 would offer buyers a 2500 rebate for the purchase of a new or used electric vehicle. The incentives go up as high as 12500 on new cars and up to 4000 on used electric vehicles.

State andor local incentives may also apply. Tesla to get access to 7000 tax credit on 400000 more electric cars in the US with new incentive reform. Reid D-32nd would have granted a state-tax rebate of up to 3500.

For more information see the Virginia DMV Electric Vehicles website. This incentive covers 30 of the cost with a maximum credit of. Joe Manchin recently announced that he just cant vote for President Joe.

Virginia electric vehicle tax credit 2022. Review the credits below to see what you may be able to deduct from the tax you owe. This irs tax credit can be worth anywhere from 2500 to 7500.

April 28 2022 930 PM. Virginia Electric Vehicle Tax Credit 2022. All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500.

Electric Vehicle EV Rebate Program. ETron EV eTron Sportback EV A7 TFSI e Quattro PHEV Q5 TFSI e Quattro PHEV Bentley. The credit amount will vary based on the capacity of the battery used to power the vehicle.

Based on your EVs battery capacity and gross weight your credit can range from 2500 to 7500 provided it also has. If you take home a new PEV that meets certain requirements such as battery capacity overall vehicle weight and emission standards you can also receive a federal tax credit of up to 2500. Either fax your application to 804 367-6379 or mail it to.

Governors Start 2022 With A Focus On Electric And Alternative Fuel Vehicles And Networks National Governors Association

Electric Cars Transport Environment

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

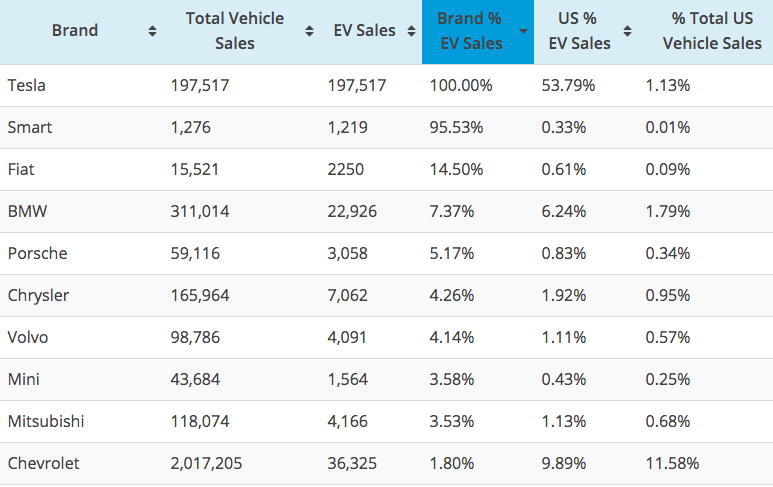

Us Ev Sales Percentages Of Total Vehicle Sales By Brand Evadoption

Electric Cars Transport Environment

Charging Car Charging Car Off 69

Driving An Electric Car In Norway A Guide For Newbies Life In Norway

Electric Cars Are Coming And If You Don T Like It Tough

Top States For Electric Vehicles Quotewizard

All Those Electric Vehicles Pose A Problem For Building Roads Wired

How Do Electric Car Tax Credits Work Kelley Blue Book

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

Electric Cars Transport Environment

Charging Car Charging Car Off 69

Charging For Electric Vehicles Off 72

Us Lags In Electric Vehicle Sales Despite Biden Administration S Push Us News The Guardian